Financial Markets IQ

About Roger Khoury and

His Clients' Experiences

Roger Khoury is an expert in the field of Market Forecasting, with over two decades of experience.

In 2010, he developed an innovative probability-based form of price forecasting (through real-time demand analysis), called Market Vulnerability Analysis™ (or MVA™), to overcome an inherent flaw he had discovered that was unavoidably baked into every trading and investment strategy developed for the world's financial markets.

This inherent flaw is the root cause of large drawdowns and inconsistent performance results.

His proprietary form of real-time demand analysis enables its user to uniquely reduce the downside risks in the market, without sacrificing the upside performance potential, through the accurate risk forecasting capability his MVA™ methodology naturally provides.

After successfully deploying his proprietary demand analysis and risk forecasting methodology (MVA™) to execute a strategy he also developed called Demand Imbalance Arbitrage™ to reach his own goals, people began to inquire about his accomplishments.

In 2011, Roger brought on partners, Bo Yoder and Dr. Jared Goldstine to help establish a training curriculum and mentoring program, in order to address those interests, initially offered through their firm RBJ Financial Group, which is the administrative arm for their education and mentoring services.

Based on the success of this venture and the insights gained from mentoring dozens of students, Roger was inspired to create an exclusive community, with a more formalized learning environment.

In 2019 Roger launched the Market Forecasting Academy to accomplish his vision for educating and mentoring active market participants on acquiring the skill of accurate and objective Financial Market Forecasting.

FinancialMarketsIq.com serves as an introductory information portal for those seeking to learn about this innovative proprietary methodology and about Roger, his training and private mentoring, as well as his exclusive community of clients, which he personally chooses during the evaluation process from the applications submitted to us through this portal.

For Roger, it's become a passion project, a labor of love.

So he deliberately keeps the operation limited to prioritize and maintain the personal hands-on approach he enjoys so much and the relationships and successes that are built through it.

We are proud to share that over 90% of our clients learn about us through word of mouth personal referrals from existing clients.

When you read through the many clients' comments about their experience, you'll understand why.

To Avoid Confusion, Please Note:

Market Vulnerability Analysis™

Was Formerly Called 3D Apex Predictive Failure Technology™

A Little Background:

Allow us to clarify some of the jargon and technical names used to describe Roger's methodology in the comments below, so there’s no confusion as you get into the upcoming client experiences.

The framework of this methodology is built on something Roger called the 3D Apex Probability Analysis Layer™ (3D Apex PAL), which was the foundation that finally provided consistent results that frequently elude market participants.

Later in 2010, he further refined the process in a way that dramatically limited the downside risk without limiting the upside profit potential.

He Never Intended On Teaching His Methodology, Until The Following Happened...

Once he achieved his goals, people began to take notice of how much time freedom he had.

While everyone else was working, people would see him regularly volunteering his time at church, helping friends and family, as well as spending a tremendous amount of time being able to visit various people and socializing throughout the week...

(A QUICK INSIGHT ON ROGER: Roger is a natural empath and is the kind of person who really enjoys meeting and helping people he feels he can connect with. He finds it energizes him, gives him meaning, and fuels his passion to be the kind of person he wished someone would've been towards him, during his life's most trying moments)

At that point, many people were referred to him (which steadily multiplied) and approached him to learn more about his methodology, which he enjoyed to teach. He found it tremendously satisfying and personally fulfilling, as he witnessed the ripple effect it had on their loved ones and circle of influence...

In 2011, He Realized That He May Have Found His Calling...

Now he felt he needed to be more formal, so he had to come up with a name for it. At the time, he called his Methodology 3D Apex Predictive Failure Technology™ because of its ability to accurately forecast (predict) which positions, though they looked good and attractive on the surface, were actually predisposed to fail before committing and being affected by a loss.

Throughout the years, he noticed that traders/investors alike often place too much emphasis on the technology aspect (even thinking they are investing in technology) when, in fact, all it does is facilitate the gathering and calculating of necessary data which saves a person time. . . which is very important...

BUT, the real power and true value is derived from the actual process of the analysis and forecasting methodology, which provides the context for how to interpret and effectively utilize the data and the indications that the technology enables.

TO BE CLEAR: This Is NOT A Technology, Software or Algorithm...

It's An Accurate, Real-Time Market Demand Analysis and Risk Forecasting Process...

Said another way: It is a methodical process that anyone can learn as a skill and use for the rest of their life!

In other words, the magic is NOT in any technology, but in the proprietary analysis process. Without which, any technology or indicator would only provide another hit or miss experience for its users.

NOTE: The Adaptive Probability-Based Analysis Process that the Methodology is built on, is based on unchanging principles, which are always in effect like gravity. Therefore, it never needs updating and has never required modification in order to maintain its effectiveness...

There's NEVER a need for a Version 2.0, which eliminates the need to constantly search for "what's working now/next" every time the markets evolve and change.

So, in time, it became clear that a more accurate representation and description of what he had developed was needed to emphasize the methodology over the technology.

Hence, it is no longer referred to as 3D Apex Predictive Failure Technology™ or The Probability Analysis Layer™ but instead, it is now referred to as: Market Vulnerability Analysis™ since it is highly adept at revealing the Market's vulnerabilities in Real-Time, which is what provides the accuracy, consistency and dependability of the forecasts it enables its users to have.

It is the engine that drives the success of his strategic approach to the markets he calls Demand Imbalance Arbitrage™ which you'll learn more about in greater detail if you qualify for complimentary access to the detailed information portal.

But whatever name is ascribed to his methodology and unique approach to the market, it’s the same tried and true (unchanged) process that has delivered consistent, reliable results since he developed it in 2010 (throughout all markets and market conditions), which will be demonstrated inside the information portal to qualified individuals.

The Upcoming Examples...

In the upcoming comments, you'll have an opportunity to review client experiences over the years, reflecting the consistency of the methodology, its unique insights, the kind of supportive environment, and the passion that's behind what this transformational opportunity offers.

Before You See What Clients' Have To Say About Their Experience with Roger

Here's A Short Demonstration of The Value of His Methodology For Context

With the right information, the markets can be accurately forecasted and the risk predicted and controlled...with total clarity, confidence and consistency, so you can intelligently AVOID the common concerns and the experience of allowing your profits to slip back into the market unnecessarily.

Because Return "Of" Capital is just as important as Return "On" Capital

Mr. Graham Rushbrook's Experience and Insights about Roger

Dr. Marc Bruell

Listen To His Experience with

Roger as a Coach and Mentor

Dr. Robert Kok Yong Ng

Compares His Past Experiences with His

Uniquely Different Experience with Roger

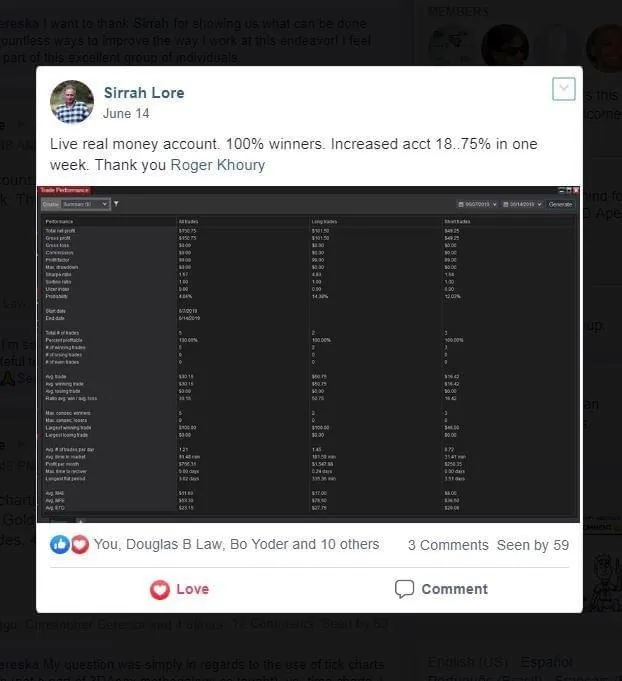

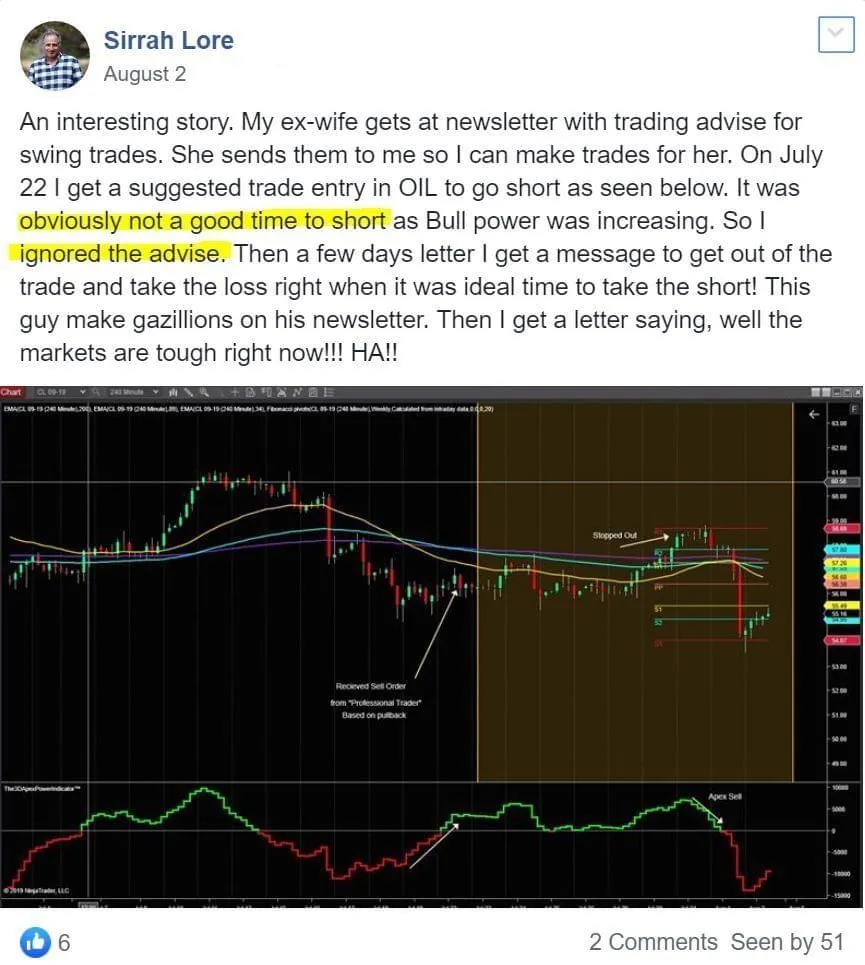

Read Through Some of These Experiences...

They Will Provide Some Context and Insight To The Common Experience

Jim P.

Clip Taken During A Group-based Event

While Demonstrating The Methodology

During Real-Time Market Conditions

In Front of a Live World-wide Audience

Riaan K.

Clip Taken During A Group-based Event

While Demonstrating The Methodology

During Real-Time Market Conditions

In Front of a Live World-wide Audience

You can be the reason someone avoids a bad experience with the markets. If you're finding this information insightful and valuable, please remember to SHARE: www.FinancialMarketsiQ.com with those you think can benefit.

U.S. Government Required Disclaimer:

Commodity Futures Trading Commission: Forex, Commodities, Futures, Bonds, Stocks, and Options trading has large potential rewards, but also large potential risk. Leverage can work for you as well as against you. You must be aware of the risks and be willing to accept them in order to trade and or invest in the Forex, Commodities, Futures, Bonds, Stocks, and Options Markets. DO NOT TRADE AND OR INVEST WITH MONEY YOU CANNOT AFFORD TO LOSE. This is neither a solicitation nor an offer to Buy/Sell Currencies, Commodities, Futures, Bonds, Stocks, or Options. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this website. THE PAST PERFORMANCE OF ANY TRADING SYSTEM OR METHODOLOGY IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

CFTC RULE 4.41 - IF HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS ARE SHOWN, THEY HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

Please Read Our Full Disclaimer/Disclosures and Terms and Conditions of Use For This Site By Clicking Here

Copyright © 2022 - All Rights Reserved, Financial Markets iQ (financialmarketsiq.com) | Roger Khoury

Reproduction without written permission is prohibited.

MY FREE GIVEAWAY THAT WILL HELP YOU GROW YOUR BUSINESS.... Fast!!

THERE ARE THREE OPTIONS FOR THIS SECTION - TRY THEM OUT IN THE MANAGE SECTIONS AREA

numquam enim ab voluptate id quam harum ducimus cupiditate similique quisquam et deserunt, recusandae.