Looking for a Predictable and Sustainable Way to Protect Your Capital AND Beat the Markets and Inflation?

Introducing: Demand Imbalance Arbitrage™ - The Only Trading Method Based On Real-Time Market DEMAND Data as an Objective LEADING Indicator of Future Price Action

As you may know, most market investors/traders are plagued with inconsistency, uncertainty, low win rates, drawdowns and risky positions - no matter how many systems or strategies they try.

WHY is that?

They're relying on systems or strategies based on LAGGING indicators derived from past data that can NEVER consistently predict future price action

They don't have access to Real-time Market Demand Data that gives them an 80%-90% accurate LEADING indication of where price is going next

They don't have a reliably consistent method of knowing with certainty AHEAD OF TIME whether their position will reach its target or struggle and fail

BUT, when you're able to know where price is going next in any market with 80-90% accuracy those problems go away.

Works with equal reliability in all markets and time-frames: Stocks, Futures, Forex, Options, Crypto

Read the Intro to DIA™ Report Below for More Info

If It Makes Sense To You and You Want To Learn More, Then Register for the Free Mini-Course

Register Below to Access the Free Mini-Course on Demand Imbalance Arbitrage™

Upon completion of the mini-course, qualified individuals will have the opportunity to apply as a potential candidate of an unconventional, high-touch training and mentorship program that will enable you to forecast the markets with uncanny accuracy, clarity, control, consistency and confidence for peaceful profits.

Demand Imbalance Arbitrage™ is the Only Method of Forecasting Future Price Action in any Market with Guaranteed 80-90% Accuracy Based on Real-time Market Demand Data.

You NEVER Have To Take Big Risk

To Accomplish Your Goals

+

You NEVER Have To Experience

Large Drawdowns (Downturns)

+

You NEVER Have To Speculate

or Gamble On Outcomes

You NEVER

Have To Take Big Risk

To Accomplish Your Goals

You NEVER

Have To Experience Large

Drawdowns (Downturns)

You NEVER

Have To Speculate

or Gamble On Outcomes

The Intro to Demand Imbalance Arbitrage™ Report

The Only Method of Forecasting Future Price Action in any Market

with Guaranteed 80-90% Accuracy Based on Real-time Market Demand Data.

DIA™ is the only way to consistently identify and take advantage of frequent, very low risk pockets of significant imbalance between price and demand . . . giving you the ability to peacefully profit from those imbalances 80-90% of the time.

This method and approach to the markets is different from anything else you’ve encountered. It has a proven track-record of client success without modification since its inception in 2011.

No other system or strategy that I know of delivers the level of CERTAINTY and predictable performance results this method guarantees in any market or economic condition.

If you see the value in what you’re presented within this intro report, you may register for access to a more in-depth, complimentary mini-course that will answer all the questions investors have asked over the last 11+ years.

For now, absorb this info and I look forward to connecting with you at a later time if it makes sense to you.

First, as a financial market investor/trader, do you often experience any of the following:

UNCERTAINTY before AND after you enter a position?

Hit and Miss Performance Results?

Lack of clarity and certainty?

Fear, doubt, stress and frustration?

Worrying about waking up to huge losses from an unforeseen market crash or major correction?

Low win rates

Large Drawdowns

Risky positions

Inability to consistently grow your account no matter what you’ve tried?

If so, keep reading . . . because you’re about to realize how it’s possible to eliminate those problems once and for all. Period.

Or, if you’re new to the markets, you can completely bypass the challenges that commonly plague the industry.

Either way, this new-found understanding has the potential to literally transform your approach to the markets AND the outcomes you can expect to produce from them.

This introductory information is for you if you’re a self-directed market investor (or new market investor) ready to experience:

Very Low-Risk Positions (Only 2% or Less Downside Risk Per Position)

High Win-Rates of 80-90% that reflect a 1-to-1 (or better) Reward-to-Risk Ratio

Low-to-No Drawdowns (2% or less)

Elimination of 80-90% of bad trades BEFORE you pull the trigger and give back your capital…these are trades that often look good but end up struggling and failing

Accelerated Account Growth with Consistency

A high level of CERTAINTY through the Clarity, Confidence, Consistency and Control that you’ll have over your investing/trading outcomes

Roger Khoury

CEO Market Forecasting Academy

Developer of Demand Imbalance Arbitrage™

Hi! I’m Roger Khoury, Founder and CEO of Market Forecasting Academy and the developer of Demand Imbalance Arbitrage™, which I’ll be introducing you to today.

But for context, it’s important you know that, like you, I’ve experienced my share of frustrations in the markets.

I started my trading journey by shelling out a small fortune to well-meaning gurus only to be disappointed again and again. No matter how hard I tried, nothing ever succeeded for the long term.

Now this doesn’t mean I was taken advantage of by anyone. But as you’ll see, even the professionals are victims of the very challenges I had to overcome on my own.

Each time I thought I had finally found what I needed, it somehow ended with yet another failure. I kept finding myself constantly looking for the next new thing that seemed to be working at the time.

And that turned out to be an endless cycle, which many professionals say… was just “the nature of the beast.”

But after 14 years and spending more than $300k on education, systems and tools during that time, I had to admit that I was not much better off than when I first began.

I may have learned a lot, but what I learned wasn’t really getting me anywhere, so the value wasn’t there for me.

This started me on a journey, which ended up with me discovering a completely different approach to the markets. And once I fine-tuned it, I was finally able to accomplish the financial goals I set for myself through the markets.

Now, I have to say, I never intended on teaching my methodology or turning it into a business. But people around me started noticing I had a lot of free time on my hands. And they started asking, what do you do? Are you a trust-fund-baby or something?

When they found out I had a very controlled approach for being consistent and outperforming the market without taking big risks or holding onto large drawdowns – in fact, it’s less risky than real estate investing - it naturally peaked people's interest. And that's when people began to ask if I'd be willing to teach them.

I remember how rewarding it was teaching Sunday school. So I was like, sure, why not? From those early successes of my first few clients, it snow-balled into an unexpected and personally gratifying new career . . . which actually feels more like a calling.

Nowadays, I have people coming to me every day who are invested in the financial markets and they're ALL very concerned about 2 main issues:

How to KEEP from losing their investment capital in an increasingly uncertain and risky financial environment. In other words, how to defend their money from getting mugged by unforeseen events, crashes or market forces that can blind-side them.

They also want to know how to safely grow their capital in a low-risk way which can FAR outpace inflation, despite the high-risk environment, so they are not forced to sit by and watch their buying power degrade as inflation drags the value of the currency down the drain.

With that in mind, I've developed an industry-first, counter-intuitive approach to the markets that fixes these 2 problems by delivering high probability returns, in any market condition, with very low risk.

In fact, for the past 11 years, I've not only taught my clients how to compound their accounts and make substantial and sustainable gains . . .

But just as important, I have trained them how to avoid giving their precious gains back, so they avoid the common roller coaster experience in the markets.

I call it Demand Imbalance Arbitrage™ - which is the only method guaranteed to consistently identify and take advantage of frequent, very low risk pockets of financial market imbalances, between demand and price . . . and profit from them 80-90% of the time.

More on this in a moment. But before we go further, it’s important to note that this isn’t for everyone.

My clients are like family. They visit my home from all over the world. So, I’m very selective about who I take on as a new client.

I have to be selective because I literally guarantee the success of my clients as they do their part.

And I take that responsibility seriously because throughout the past 11 years, I have never let anyone down that did their part. And I’ve never received a single complaint or bad review.

Google me and you’ll see that’s true. Bad news travels much faster than good news online.

Since my credibility and reputation is on the line every time I take on a new client, I’ve developed a process to filter out the type of people that would not be a good fit – i.e. those who I could not in good conscience guarantee their success.

This is why I turn down 2/3rds of those who apply to work with me.

It really needs to be the right fit.

So, potential candidates in my training and mentoring program have to earn it by demonstrating they have the character traits of someone I’d feel comfortable guaranteeing their success. . . by demonstrating diligence by doing their due-diligence on me and my method first . . . and then applying and having an evaluation interview.

Reading this document is the first of several steps you’ll need to take before we get to the possibility of working together.

More on that later.

For now, let’s continue with this vital question:

What is the single biggest obstacle to achieving long-term, sustainable, predictable success in the markets?

Can you guess what it is . . . because it probably isn’t what you think?

But when this obstacle is finally dealt with, ALL the other problems AUTOMATICALLY go away.

Ready?

The single biggest CORE obstacle to trading success is UNCERTAINTY!

UNCERTAINTY is the ultimate long-term success killer in the markets.

It’s the UNCERTAINTY about what price is going to do next.

It’s the UNCERTAINTY about whether or not your position is going to reach its target BEFORE you have to pull the trigger and commit to the position.

It’s UNCERTAINTY about whether conditions have changed AFTER you’re in the market and what to do about it.

I’m sure you’ll agree that IF YOU HAD AN 80-90% LEVEL OF CERTAINTY on the above points, you’d have a completely different experience and outcome in the markets, right?

But, if you can’t ELIMINATE the UNCERTAINTY . . . you’ll never achieve long-term success in the markets . . . no matter what trading system, strategy or signals service you use . . .

Because you're always going to be UNCERTAIN about what is going to happen next . . . and by the time you find out, it’s often too late. . . UNLESS . . . you can overcome what I call “The 3 Causes of Uncertainty.”

Cause of Uncertainty #1:

Relying on LAGGING Indicators

Most traders focus on PRICE or other LAGGING indicators such as MACD, RSI, Moving Averages, OBV, Bollinger Bands, Keltner channels, etc. (along with all the other and too many to list indicators).

The problem with LAGGING indicators is that they are all BASED ON THE LIMITS OF PAST DATA.

This renders them useless for accurate and consistent forecasting of FUTURE outcomes.

How can you ever have certainty about the future, based solely on past information?

You can't.

Here’s the insight: Instead of chasing price around the chart and literally GUESSING and GAMBLING where it’s going . . .

Pay attention instead to market DEMAND. . .

DEMAND is the true LEADING indicator because Price ALWAYS follows Demand.

Think about it, what causes price to rise and fall in any market? DEMAND! Right? Price will always ultimately reflect where the demand is and where the demand is expanding or contracting.

So, if you want to know where price is going, you need to be able to identify the real-time DEMAND . . . Because Price itself is a lagging indicator to demand!

How do you identify real-time demand, so you can be ahead of the market instead of victimized by it?

This brings us to Cause Uncertainty #2.

Cause of Uncertainty #2:

Not Having COMPLETE Objective Data to Identify Real-Time Demand

This simply means that you have an incomplete picture of what's going on. And that leads you to trading blind.

Did you know there are 8 Major Demand Factors that move price?

But most people only use one or two of them - like fundamentals and technical analysis.

But there are 6 more factors they aren't accounting for. And then they wonder why they get surprised and blind-sided by seemingly unseen forces.

The 8 Major Market Demand Factors That Move Price Are:

1. The fundamentals and traditional Graham-Dodd, Warren Buffett style forces

2. Geopolitical forces (Including Central-bank and Macro-economic effects)

3. Volatility phase shifts

4. Market sentiment

5. Liquidity Levels (Includes Volume as well as Order Flow & Trade Flow)

6. Prime liquidity pools (Essentially hidden to the untrained eye), which HFT algorithms, Brokers and Market-Makers love to target

7. Imbalances in Supply and Demand

8. Technical analysis factors and its effects on the market (takes into account and replaces the most useful technical indicators that traders use), including Fibonacci, Elliott Wave and Gann)

If you’re not taking ALL of these DEMAND factors into account, you will be blind-sided by them.

And you’ll continue experiencing inconsistent performance results. You’ll continue experiencing too much risk and large drawdowns. And you’ll continue giving your capital back to the markets unnecessarily.

Now, I know the above factors may seem like an overwhelming amount of information to track.

But, actually, it’s NOT . . . Because I’ve combined all these Demand factors into a simple, visually intuitive indicator . . .

For the first time giving users a LEADING, real-time Market Demand Indicator . . .

So you always know where price is going next with an 80-90% accuracy.

*** You'll see many examples of this later on in the mini-course should you continue to evaluate this methodology.

Cause of Uncertainty #3

Every Trading System or Strategy Has a Fatal Flaw

If you have ever wondered WHY a strategy or system seems to perform well for a while, but it always eventually falls apart, no matter how diligent and disciplined you are at sticking to the rules . . .

THIS is why.

Because no matter what system, strategy or signals service you use - they are all subject to something I call the Fatal Flaw, which is a like a ticking time-bomb.

And it’s unavoidably baked into every strategy, system, and signals service you’ll ever encounter . . . no matter how simple or complex it is and no matter how much cutting-edge technology is behind it.

The reason is simply this: Every system or strategy for buying and selling in the markets are necessarily developed based on conditions that WERE current at the time.

However, when market conditions change just enough (as they always do), the effectiveness and profitability of the strategy will change. And it will therefore begin to work poorly, inconsistently, or not at all.

THAT IS THE INHERENT FLAW IN ALL STRATEGIES AND SYSTEMS, AND THIS IS THE REASON...

Why all market participants are doomed to eventually experience inconsistency, potentially large drawdowns (downturns), and uncomfortable or untimely losses (which is a form of gambling).

This causes most market participants to continually look for "the next new thing," or "what's working now" because whatever was being used, was not and could not be sustainable.

This endless cycle continues for over 90%+ of those involved in the industry, because most are unaware of the inherent flaw and do not realize what you are learning about here...

SO, WHAT'S THE REMEDY, WHEN THE ONLY CONSTANT IS "CHANGE" ITSELF?

You MUST have a reliable way to objectively measure and value the changes in market DEMAND as it continually evolves in Real-Time, while also having a way to measure and value its impact on price, which is exactly what my methodology delivers.

Now That You Know the 3 Underlying Causes of UNCERTAINTY, Which Are. . .

1. Relying on Lagging Indicators (including, Price which is a lagging indicator)

2. Not Having the COMPLETE Data that Provides Total Objectivity to Identify Where the Real-time DEMAND is, at Every Moment

3. The Fatal Flaw Inherent in all Systems/Strategies

Let me ask you this . . .

If You Could ELIMINATE the Uncertainties In ANY Market or Time-frame. . . And were CERTAIN of a favorable OUTCOME 80-90% of the time. . .

How would that change your experience?

Would you be less-stressed, more relaxed and confident?

Would your trading/market investment outcomes be more positive and consistent?

Based on my clients’ experience over the last 11 years, the answer is a resounding YES!

***You’ll have the opportunity of seeing many examples of client experiences as you continue to evaluate this for yourself inside the mini-course.

And that brings us to the ONE skill that permanently eliminates uncertainty once and for all.

How to Accurately Forecast Future Price Action Based on Accurate

Real-time Market Demand

Because remember, if you know where the demand is, in REAL TIME . . . Then you also know where price is going and what it is most likely going to do next! Because demand moves FIRST, then price follows after.

And the simplest and most profitable way to trade the market, is by identifying when and where there are significant imbalances between where price is and where the actual demand is.

The key is knowing when there’s a significant imbalance, which happens all the time throughout each and every week . . . and this provides you with frequent, low risk, high probability opportunities for profit.

Demand Imbalance Arbitrage™

I call it Demand Imbalance Arbitrage™, which is an innovative, industry-first methodology, that eliminates the uncertainty, the inconsistency and large drawdowns traditionally experienced in the financial markets . . .

And it's the only method guaranteed to consistently identify and take advantage of frequent, very low risk, pockets of significant imbalance between price and demand . . . giving you the ability to profit from those imbalances 80-90% of the time.

In other words, your analysis will be objective and will be right, at least 80 to 90% of the time!

Think about what it would mean to you and how you will feel when you know your analysis of what the market will do, is going to be right at least 80%-90% of the time . . .

And especially, when your downside risk is never more than 2% of your brokerage account capital.

Let me explain it another way – to keep things simple.

Price in any market goes up or down based on where the demand is, right?

So if there’s more demand for something, then price goes up.

And if there’s less demand, then price goes down.

Now keep in mind that demand always leads price.

Wherever demand is going, whether up or down, price ultimately follows.

So, remember – as we discussed before - this means DEMAND is a LEADING indicator of where price is going next . . . as opposed to all the traditional LAGGING indicators that can NEVER give you an accurate or reliable indication of where price is going next . . .

Because they’re inherently limited by the past and will ultimately provide you with a hit or miss, inconsistent experience, as the market continually and endlessly evolves.

But with a real-time DEMAND indicator along with my market analysis methodology, you now have a reliable LEADING indicator that provides you with a level of CERTAINTY you’ve never had before.

Now with the financial markets in particular, due to the hundreds of thousands of interactions that people all around the world have with the markets on an almost a daily basis…

This naturally creates a virtually endless situation where demand is constantly expanding or contracting. And this causes price to constantly fluctuate as it’s constantly chasing after where the demand is moving to at each given moment.

And this fluctuation creates frequent IMBALANCES between where price is and where the demand actually is.

So this is what causes price itself to endlessly cycle up and down each and every minute of the day, as it works to catch up to where the demand shifts to moment by moment. Makes sense, right?

There’s another level of distinction that’s important here. Because not all demand imbalances are equal.

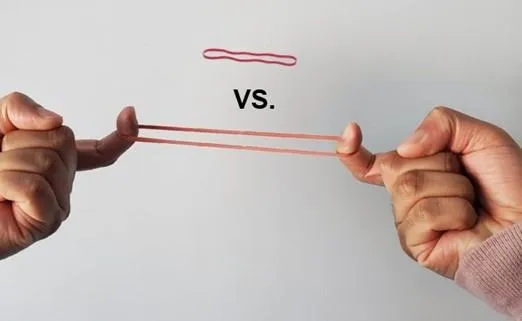

Think about a rubber band. If you take a rubber band and just hold the two ends without stretching it much, not much is going to happen, right?

Because it’s not stretched out enough in a significant way, there’s not enough potential energy or force to cause any reliable movement to snap back.

But what happens if you pull that rubber band as far apart as it can go?

Now, there’s much more likelihood that when you release it, it will snap back with a very CERTAIN force.

BEING ABLE TO SEE THE LEVEL OF DEMAND IMBALANCE IN THE MARKETS IS WHAT GIVES YOU CERTAINTY IN EITHER TAKING A POSITION OR PASSING.

Okay, so here’s where it gets interesting…

80-90% of the time, the market is like that unstretched rubber band.

Price is too close to Demand – which also means your level of certainty is too low to entertain a position in the market because there’s not enough potential energy to predict with certainty what will happen.

It would be too risky, no matter how juicy or good looking an opportunity may otherwise seem to you.

So, you simply choose to PASS on those trades – eliminating the potential losses and drawdowns you would have otherwise sustained from something that doesn’t have the high probability you need for a low-to-no-stress experience.

On the other hand, about 10% to 20% of the time, the market is like the stretched-out rubber band. Demand moves more quickly and more dramatically than price, which goes well beyond the normal imbalances that frequently occur.

And this creates a significant imbalance that represents a very low risk, high probability opportunity to profit from. Those significant, short term imbalances, is precisely what enables an investor to ARBITRAGE, or capture the difference as profit, as price catches back up to where the demand is.

This is what we call Demand Imbalance Arbitrage™.

We’re arbitraging or taking advantage of the difference between those discrepancies, giving an investor an 80-90% win rate, with an average of 2% or less in downside risk per position.

So, it dramatically reduces and limits the normal downside risk without limiting the upside profit potential.

By the way, this also means you avoid the common experience of holding onto large downturns. And that includes being able to accurately predict in a timely manner when and where a significant correction or crash is most likely to occur and therefore that stressful experience can be avoided as well.

How to Avoid or Predict a Market Correction or Crash

Demand is made up of multiple factors – The 8 Major Demand Factors That Move Price - that we previously discussed.

Each of which are identifiable and take time to build.

Just like a thunderstorm or hurricane, it takes multiple factors to come together to form the right environment for a storm, right?

I mean, you and I can’t walk out under a clear blue sky and have it suddenly start pouring rain on us with lightning and thunder, correct?

We would first see clouds rolling in, the temperature, humidity, wind and air pressure changing, and so on and so forth. right?

These are identifiable factors that took some time to build…

Which makes it a forecastable event, right?

And now that means it also gives you time to take the appropriate action, so you’re not surprised or caught unprepared by it.

It’s exactly the same in the financial markets.

It’s just that up until this methodology was developed, there was no way of knowing AHEAD OF TIME and in a TIMELY MANNER that real-time Demand was taking a nose dive. . . and setting up the conditions for a major correction or crash.

This is why most are caught off guard, surprised and victimized by unforeseen sudden price movements they had no way of preparing for in a timely manner.

But now, when you can see real-time Demand shifting dramatically downward - significantly away from price . . .

Meaning it’s created the perfect environment for price to significantly correct or crash upon the slightest trigger. . .

That’s when you know it’s time to take defensive action or even profit from it.

And fortunately, this environment usually takes days and even weeks to build.

So, there’s enough time to act when it matters most.

If you’ve grasped the importance of what I’ve described above, you can now see WHY . . .

This Methodology Enables Both New and Experienced Traders/Investors to:

Confidently forecast what's going to happen next in any market or timeframe with 80-90% win-rate with very low risk

Filter out 80-90% of the trade opportunities that may look good on the surface, but are in fact likely to struggle and fail

By Learning This ONE Skill - Accurately Forecasting Future Price Action Based on Real-time Demand Data - You'll Have What I Call the 4 Vital Cs for Stress-free Trading:

1. Clarity (with total objectivity)

2. Consistency (with low-risk, 80-90% win rates)

3. Control (over your performance and experience)

4. Confidence (which comes from CERTAINTY)

Now, when some people are initially introduced to this unconventional method, they wonder if they’re smart enough and if they can do this.

And to that we say: If you can follow directions and can use the basic functions of a computer, then YES!

It doesn’t take smarts or aptitude…it’s your ATTITUDE about following a proven process.

To Summarize, Here Are The Major Benefits of Investing/Trading in the Financial Markets with Demand Imbalance Arbitrage™:

Know with 80-90% certainty AHEAD OF TIME whether your position will reach its target or struggle and fail (Yes, BEFORE you have to pull the trigger and commit)

Experience consistent, reliable and sustainable performance results, month after month, year after year

Have confidence because you’re able to experience a true win-rate of 80-90% with very low risk

Get rid of the fear, doubt and stress of second-guessing yourself

Accelerate your financial goals with unparalleled control over your trading experience and outcomes

Make more by losing less. Filter out 80-90% of trade opportunities that look good but are likely to struggle and fail BEFORE you take a position and risk your capital (so you can reliably avoid giving back important gains)

Avoid market crashes and corrections that cause perpetual boom-bust cycles

No more worries about large drawdowns

No more ‘gambling’ or taking big risks

Works with equal reliability in all markets, conditions and timeframes: Stocks, Futures, Forex, Options, Crypto

Sustainably and predictably create cash-flow, replace your income and grow a comfortable retirement account

The Next Step In Your Evaluation of Demand Imbalance Arbitrage™

THIS INTRODUCTORY REPORT ONLY PROVIDES A GLIMPSE INTO THE VALUE THAT THIS UNCONVENTIONAL METHODOLOGY DELIVERS.

So, if what you’ve seen so far makes sense, then I invite you to take the next step in your evaluation process . . . because there is much more to see before fully realizing the potential this profitable skill offers and whether or not it’s right for you.

We’ve prepared an educational site and Free Mini-Course on Demand Imbalance Arbitrage™ for qualified individuals.

It includes many more details about how the methodology works, examples from live forecasted market events, client experiences, performance results and much more.

Register Below to Access the Free Mini-Course on Demand Imbalance Arbitrage™

Upon completion of the mini-course, qualified individuals will have the opportunity to apply as a potential candidate of an unconventional, high-touch training and mentorship program that will enable you to forecast the markets with uncanny accuracy, clarity, control, consistency and confidence for peaceful profits.

U.S. Government Required Disclaimer:

Commodity Futures Trading Commission: Forex, Commodities, Futures, Bonds, Stocks, and Options trading has large potential rewards, but also large potential risk. Leverage can work for you as well as against you. You must be aware of the risks and be willing to accept them in order to trade and or invest in the Forex, Commodities, Futures, Bonds, Stocks, and Options Markets. DO NOT TRADE AND OR INVEST WITH MONEY YOU CANNOT AFFORD TO LOSE. This is neither a solicitation nor an offer to Buy/Sell Currencies, Commodities, Futures, Bonds, Stocks, or Options. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this website. THE PAST PERFORMANCE OF ANY TRADING SYSTEM OR METHODOLOGY IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

CFTC RULE 4.41 - IF HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS ARE SHOWN, THEY HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

Copyright © 2022 - All Rights Reserved, Financial Markets IQ (FinancialMarketsiQ.com) | Roger Khoury